Irs Loss From Rental Property Income

Surely you didn’t buy your second property with the hope or expectation that it would decline in value. Real estate markets fluctuate, however, and the U.S. economy has not been kind to property investments in many parts of the country. After years of renting our your second property, perhaps you’re coming to realize that its value is significantly less than the purchase price. The good news is that you might be able to turn lemons into lemonade in the form of tax benefits.

Ordinary Income Tax vs. Capital Gains Tax

The Internal Revenue Service (IRS) generally doesn't allow passive losses from real estate investments to be deducted from any type of income other than rental profits. However, there are a few. To get your total loss amount, you’ll subtract the amount your property sold for from that tax basis. So, if you bought your rental at $300,000 and made $10,000 in upgrades, you’ll have a tax basis. Deduct these items on Schedule E to the extent of your rental income: Mortgage interest; Real estate taxes; Other rental expenses; If reporting loss on rental property, it might be limited by the at-risk rules and passive-loss limits. However, a special allowance exists for the passive-loss limits. If the monthly rent payment is less than the. Many rental real estate properties could run up tax losses in 2020 and maybe beyond. Tax Guy covers the most important federal income tax questions and answers for rental property owners.

In case you don’t have much grounding in tax law, a few definitions will help you navigate the implications of your rental property sale. First, there are two broad categories of deductions to keep in mind: ordinary income tax deductions and capital gains tax deductions.

Ordinary income is, generally speaking, your wages and basic interest income – the main items that most taxpayers need to report on their IRS 1040 every April. Capital gains result from selling a capital asset, such as a stock, for more than its purchase price, or basis. Capital gains are taxed at lower rates than ordinary income, and are reported on Schedule D of the 1040.

Although profit on selling a rental property might have to be reported as capital gains, losses when selling rental property are deductible from your ordinary income. Learn more about the different types of taxable income on the Internal Revenue Service (IRS) website on “Capital Gains and Losses.”

Using Your Tax Basis to Calculate Your Loss

The first step in calculating your loss is figuring out your property’s “tax basis,” which you will later compare to your property’s sale price.

To determine your tax basis, add the amount you purchased your property for, plus any improvements (for example, renovations or additions, but not repairs) that you haven’t previously deducted from your taxes. These deductions include closing costs, such as legal fees and title insurance. Next, subtract any depreciation deductions that you’ve previously taken.

As an example, let’s say you bought a property for $200,000 and made $10,000 in upgrades. This gives you a $210,000 tax basis. But you’re in a rough real estate market, and need to sell for $100,000 – a huge loss. In fact, when you subtract your tax basis from your sales price, you find that your loss totals $110,000, for tax purposes. That loss may be deductible.

No Deduction Allowed for Sale of Primary Residence

Importantly, the U.S. tax code does not allow deductions of losses for your residence, that is, the home you actually lived in – only for sale of investment-related property. As long as you’ve categorized your rental property as such, you should be able to take advantage of this benefit.

Converting Personal Residence to Rental Property for Purposes of Deducting Losses

Although you may think that you can get around the personal-residence rule (described above) by simply converting your home into a rental property before selling, this only works to a point. The U.S. government will not allow you to deduct losses in value from the time period before the rental conversion.

In other words, if you lived on the property before you officially began reporting it to the IRS as a “rental property,” and the house declined in value before the conversion, this might not be considered a tax loss. However, a loss from a decline in value after conversion to a rental is likely deductible.

Getting Professional Help May Be Worth the Cost

As you can appreciate, the nuances of these sales can be complex. Some are outlined on the IRS website on“Business or Rental Use of Home.” Make sure to consult an accountant or tax attorney and to figure out the tax basis of your property before you sell. This is a situation where “do it yourself” can be mostly if done incorrectly. The upfront cost of a professional consultation is far less than the risk of an audit of what will be a substantial sum of money.

It is extremely common for landlords to have rental losses, especially in the first few years they own a property. Indeed, IRS statistics show that over half of the filed Schedule E forms reporting rental income and expenses each year show a loss. If you have a rental loss, you have plenty of company.

Losing money in any business venture is never fun, but it can have tax benefits. As a general rule, you may be to deduct your losses from other income you have, such as income from a job or other investments.

Unfortunately, this general rule does not apply to rental losses. Complex IRS rules may prevent you from deducting all or part of your rental losses from the other income you earn during the year, which could end up costing you thousands of dollars in extra taxes. However, there are also important exceptions to the rules that were created to help small landlords and others in the real estate industry.

What Are Rental Losses?

Irs Loss From Rental Property Income Tax Act

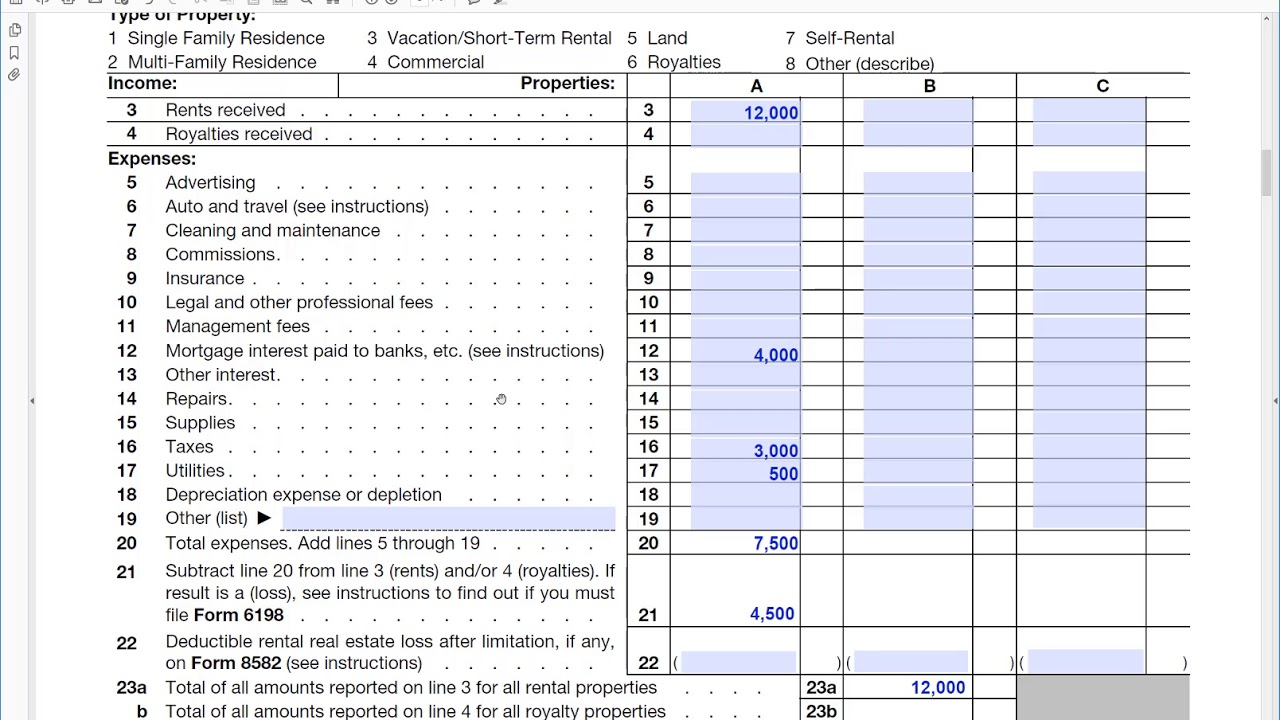

You have a rental loss if all the operating expenses from a rental property you own exceed the annual rent and other money you receive from the property. If you own multiple properties, the annual income or losses from each property are combined (netted) to determine if you have income or loss from all your rental activities for the year. You report your rental income and deductible expenses on IRS Schedule E.

Often, you have a loss for tax purposes even if your rental income exceeds your operating expenses. This is because you get to depreciate (deduct) a portion of the cost of your rental property each year without having to lay out any additional money.

Rental Losses Are Passive Losses

Here's the basic rule about rental losses you need to know: Rental losses are always classified as 'passive losses' for tax purposes. This greatly limits your ability to deduct them because passive losses can only be used to offset passive income. They can't be deducted from income you earn from a job or investments such as stock or savings accounts.

Passive income is the income you earn from rental real estate or other passive activities. An activity other than real estate is considered passive if you don't 'materially participate' in it--that is, work at it for a minimum number of hours each year--usually 750 hours. Passive income does not include income from a job, a business you actively manage, or investment income. Thus, for example, you'd have passive income if you earn a profit from one or more rentals.

Without passive income, your rental losses become suspended losses you can't deduct until you have sufficient passive income in a future year or sell the property to an unrelated party. You may not be able to deduct such losses for years.

In short, your rental losses will be useless without offsetting passive income.

Exceptions to Passive Loss Rules

Irs Rental Income Guide

There are only two exceptions to the passive loss ('PAL') rules:

- you or your spouse qualify as a real estate professional, or

- your income is small enough that you can use the $25,000 annual rental loss allowance.

Property owners with modified adjusted gross incomes of $100,000 or less may deduct up to $25,000 in rental real estate losses per year if they 'actively participate' in the rental activity. You actively participate if you are involved in meaningful management decisions regarding the rental property and have more than a 10% ownership interest in the property. This allowance is phased out for taxpayers whose MAGI exceeds $100,000 and eliminated entirely when it exceeds $150,000. Thus, it is useless for high-income landlords.

The other exception to the PAL rules is the one for real estate professionals. Unlike the $25,000 exception described above, this is a complete exemption from the rules--that is, landlords who qualify as real estate professionals may deduct any amount of losses from their other non-passive income.

To qualify for this exemption, you (or your spouse) must spend more than half of your total working hours during the year in one or more real property businesses--a minimum of 751 hours is required. In addition, you must “materially participate” in your rental activity. This requires that you work a certain number of hours at your rental activity during the year. For example, you would materially participate if you work at least 500 hours during the year at the activity. You can qualify in other ways as well.

If you own more than one rental property, you are required to materially participate for each rental property you own unless you file an election with the IRS to treat all your properties together as one single activity. This way, you can combine the time you spend working on each rental property to satisfy the material participation test. If you fail to file the election, you’ll have to materially participate for each rental property you own. For most landlords, this is impossible to do, which makes filing an election very important.

Irs And Rental Property

For detailed guidance on this complex area of tax law, refer to Every Landlord's Tax Deduction Guide, by Stephen Fishman (Nolo).